Financial Accountability

UNICEF is the world’s farthest-reaching humanitarian organization for children, and we have been working in Canada for 70 years. We work tirelessly in the world’s most complex situations to bring life-saving aid and long-term support to children and their families.

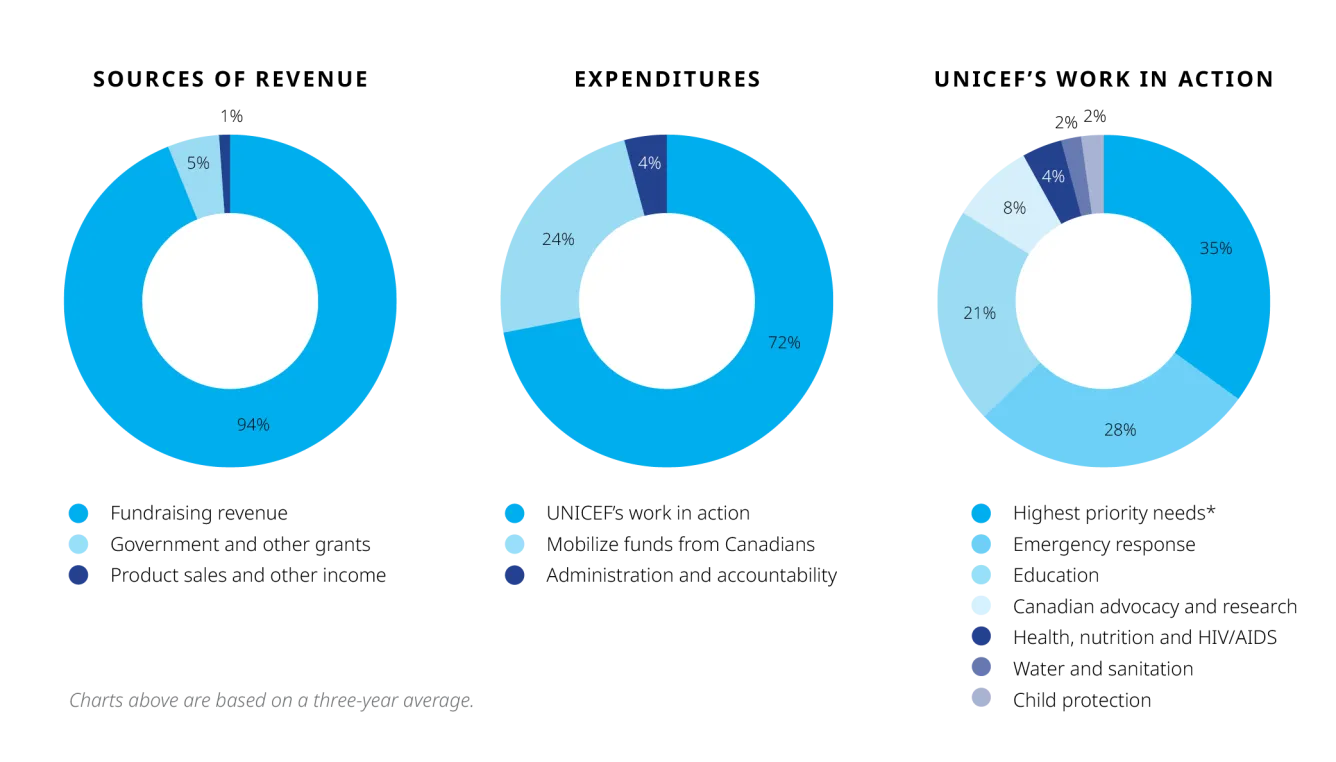

Our commitment to helping every child survive and reach their potential is also our commitment to using every donor dollar effectively and efficiently.

For more information, visit unicef.ca/WhereYourMoneyGoes.

Note: Funds to UNICEF Global Headquarters from Global Affairs Canada are not included as a source of revenue.

We work with governments and a variety of stakeholders to ensure that funding decisions are data-driven, results-oriented, scalable and are supported by the communities where we work. And our ability to collaborate with governments around the world to scale up UNICEF projects means that the impact of donor dollars is multiplied many times over.

We set the standard for trust and transparency

In the 2024 Aid Transparency Index, UNICEF ranked first among 50 major global aid organizations for financial and budget transparency, outperforming the World Food Programme, the World Bank and Global Affairs Canada.

IMAGINE CANADA ACCREDITED

We are one of only 280 charities across Canada to meet the rigorous accountability guidelines of the Imagine Canada Standards Program. With this accreditation, you can be assured that UNICEF Canada has met the highest standards for:

- Board Governance

- Financial Accountability and Transparency

- Fundraising

- Staff Management

- Volunteer Involvement

ANNUAL Reports

You can see the impact of donor support on the lives of children, families and communities, and more on how funds are allocated in our Annual Reports and Financial Statements.

Financial Statements

Canada Revenue Agency

UNICEF Canada is a registered charitable organization with the Canada Revenue Agency. Public portions of our annual information return (T3010) can be viewed here.